RETIREMENT REALITIES

10%

The compound annual return in the S&P 500® between 1965 and 2019.1

$50,860

The average amount spent on living expenses by Americans aged 65 and older.2

25%

The percentage of Americans on track to maintain their lifestyle in retirement.3

FIA BENEFITS

Index-Linked Growth

Your FIA allows you to share in some market gains by earning interest based on the performance of an index like the S&P 500®.

Flexibility

Our FIAs offer three crediting strategies for you to earn interest - two based on the S&P 500® and a third that credits a fixed interest rate. Each year you will have the option to reallocate your funds among the three strategies.

Tax-deferred Growth

You only pay income tax on your money when you begin taking withdrawals. Until then, more of your money works for you.

Leave a Legacy

Leave a legacy for your beneficiaries and avoid probate. Your FIA will pay the full value of your annuity as a death benefit if you pass away.

Principal Protection

Although your annuity may grow with positive market performance, your funds are not directly invested in the stock market or S&P 500® Index. As a result, your annuity is guaranteed to never decrease in value even during periods of negative index performance.

No Administrative Fees or Charges

With no set-up or administrative charges, your entire premium accumulates interest immediately.

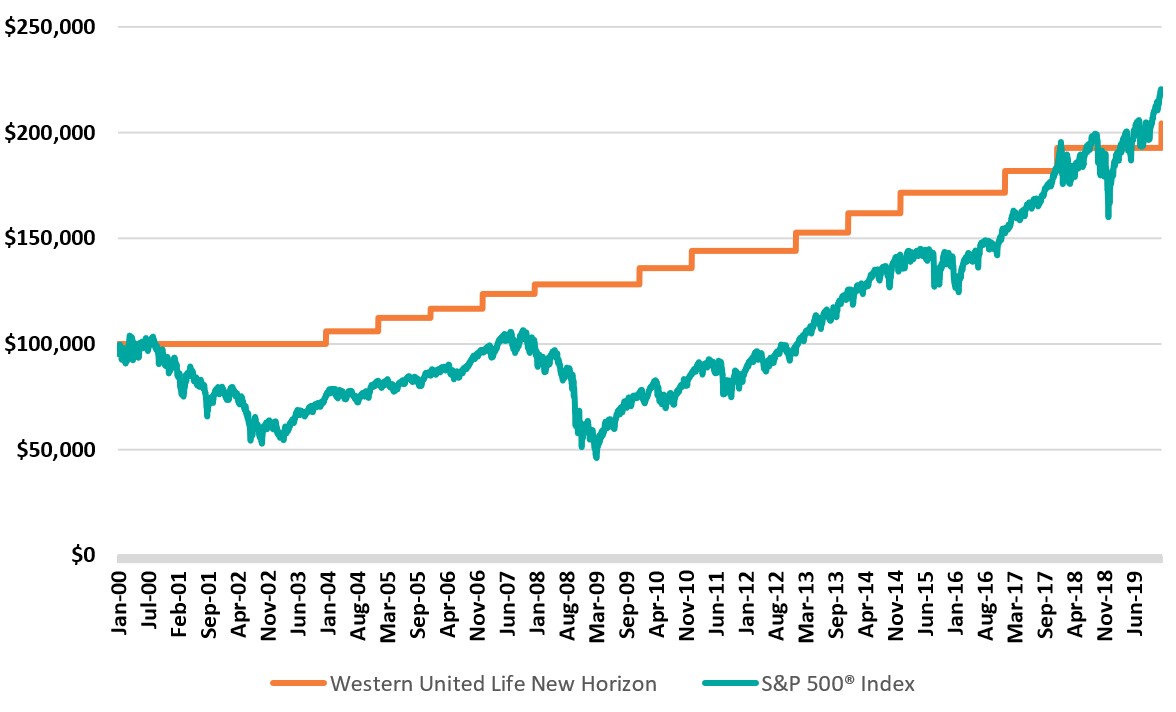

As an illustration of the power of principal protection, the following example compares the performance of $100,000 in premium in an accumulation-focused FIA with the performance of $100,000 invested in the S&P 500®.

Power of Principal Protection

This is a hypothetical example and does not illustrate the future results of either the market or the Western United Life New Horizon FIA. This example assumes no partial or full surrenders and that all funds are allocated to the Point-to-Point with Cap Strategy at a cap of 6%. Actual and future cap rates may be above or below this amount. This example is for illustrative purposes only and does not represent the performance of any specific product or investment.

OUR PLANS

Western United Life

New Horizon

- Free Withdrawal: 10% of the annuity value

- Lower Crediting Rates

Western United Life

New Horizon Plus

- Free Withdrawal: 5% of the single premium (less previous withdrawals)

- Higher Crediting Rates

Benefits of Both Plans

- Single premium accumulation-focused FIA

- Available with 7- or 10-year surrender charge period

- Option to allocate funds among:

- Fixed interest strategy

- Index strategy with cap

- Index strategy with participation rate

- Waiver of surrender charges:

- Death of annuitant

- Terminal illness

- Nursing home confinement

ManhattanLife is a group of operating life and health insurance companies: Manhattan Life Insurance Company, Western United Life Assurance Company, Family Life Insurance Company, ManhattanLife Assurance Company of America, and Standard Life and Casualty Insurance Company.

ManhattanLife was founded in 1850 and was one of the early pioneers in the life insurance industry. Since then, ManhattanLife and its affiliated companies have provided secure and innovative life and health insurance products and services to more than 700,000 policy and contract holders throughout the United States.

Withdrawals made prior to age 59½ are subject to ordinary income taxation and may be subject to tax penalties. Neither ManhattanLife nor any of its subsidiaries or representatives provide tax, legal, or accounting advice. Please consult your personal tax advisor.

This annuity is NOT: 1) a certificate of deposit (CD); 2) FDIC or NCUA insured; 3) insured by any federal government agency; or 4) guaranteed by a bank, savings association, or credit union. Guarantees are based on the financial strength and claims-paying ability of ManhattanLife.

This material is intended for use with the general public to provide educational information only. It should not be considered, and does not constitute, personalized investment advice. Please contact one of our insurance producers for product details and benefits.

Sources for statistics: 1“The average stock market return over the past 10 years”, Business Insider, August 2020; 2Consumer Expenditure Survey, Bureau of Labor Statistics, 2018; 3”The Four Pillars of the New Retirement”, Age Wave and Edward Jones, October 2020. (qtd. Thinks Advisor).

Western United Life New Horizon and Western United Life New Horizon Plus are issued by Western United Life Assurance Company (WULA) domiciled in the state of Washington. WULA annuity contracts are administered at its Home Office in Spokane, Washington. Western United Life New Horizon form numbers: ICC20-SPFIA-MVA; ICC20-WUNHZ. Western United Life New Horizon Plus form numbers ICC20-SPFIA-MVA; ICC20-WUNHP.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Western United Life Assurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Western United Life Assurance Company. Western United Life Assurance Company’s product(s) is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® Index