Unpacking Medicare Supplement: Part 2

After studying Medicare a little further before enrolling, Maggie becomes curious about Medicare Supplement or Medigap. She wonders how it might enhance her health coverage. She then sorts through a number of resources before landing on some valuable pages discussing it in depth. To her amazement, Maggie learns that:

Medicare Supplement or Medigap is a type of insurance policy that helps offset the unaccounted-for parts of Medicare. Original Medicare only covers some of the expenses for healthcare services and supplies.

Yet, a Medigap policy is different from a Medicare Advantage Plan because those plans are another way to get your Part A and Part B benefits, while a Medigap policy covers expenses that Original Medicare does not cover. Insurance companies usually cannot sell you a Medigap policy if you have coverage through a Medicare Advantage Plan or Medicaid.

Plans Galore

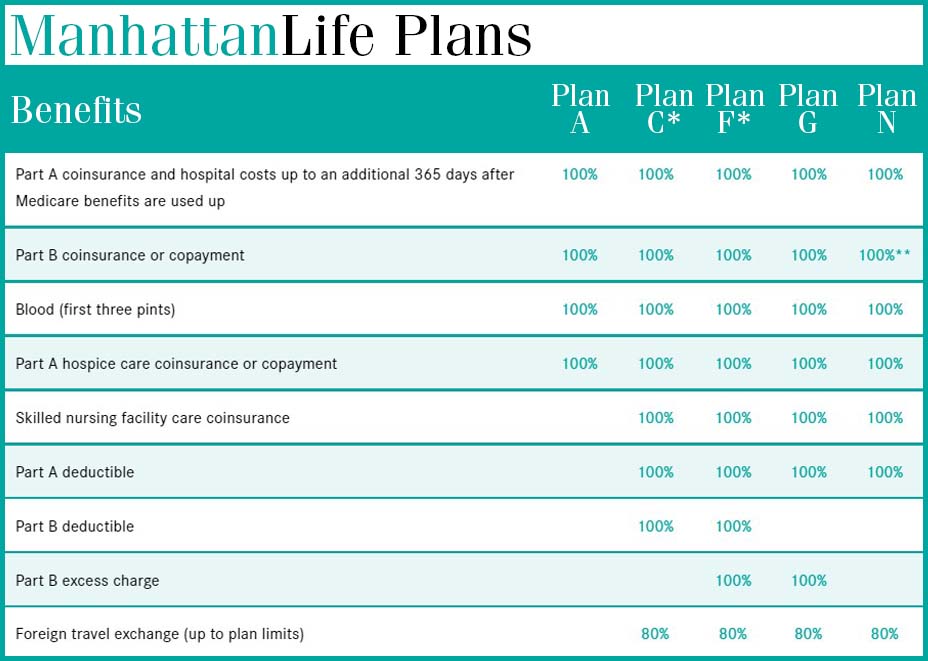

There are several standardized Medigap plans available.

All insurance companies that sell Medigap policies must offer Plan A. If they want to offer policies in addition to Plan A, they must also offer either Plan C or Plan F to individuals who are not new to Medicare and either Plan D or Plan G to individuals who are new to Medicare. Availability of Medigap policies will vary by state.

Beginning January 1, 2020, Medigap plans sold to people new to Medicare cannot cover the Part B deductible. Consequently, people that are new to Medicare can no longer obtain Plans C and F on or after January 1, 2020.

The chart below, from the Centers for Medicare & Medicaid Services, presents current Medigap plans.

%202022.jpg?ver=2022-10-31-100840-357)

Maggie absorbs the material, and then starts to consider what Medigap policies do not cover. She finds out:

They do not cover long-term care (such as non-skilled care received in a nursing home), vision or dental services, hearing aids, eyeglasses, and private-duty nursing.

“Goodness me,” Maggie remarks to herself. “There is so much to understand about Medigap and what it fully entails.”

Mere seconds later, she comes across a list of imperative facts on the subject:

Facts Before you Go (and purchase Medigap)

- You must have Medicare Part A (Hospital Insurance) as well as Medicare Part B (Medical Insurance).

- If you have a Medicare Advantage Plan but are planning to return to Original Medicare, you may apply for a Medigap policy prior to your coverage ending. The insurance company can sell the policy only if you are ending the Medicare Advantage Plan.

- If you enroll in Medigap, you pay the private insurance company a premium for your Medigap policy in addition to the monthly Part B premium you pay to Medicare.

- It is essential to note that a Medicare policy only covers one person. If you and your spouse both want Medigap coverage, each of you will have to purchase separate Medigap policies.

- Throughout your Medigap Open Enrollment Period, you can buy a Medigap policy from any insurance company licensed in your state.

- Insurance companies can charge different premiums for identical Medigap plan types. While browsing policies from various companies, be sure to compare policies under the same plan type.

- Some states have laws that might provide additional protections.

Timing matters with Medigap

The ideal time to purchase a Medigap policy is during your Medigap Open Enrollment Period which lasts for 6 months and starts on the first day of the month you are both 65 or older and enrolled in Medicare Part B. Though some states have additional Open Enrollment Periods.

If you are under 65 and have Medicare because of a disability or End-Stage Renal Disease (ESRD), you might not be able to purchase the Medigap policy you prefer, or any Medigap policy, until the age of 65.

Throughout your Open Enrollment Period, an insurance company cannot use medical underwriting to determine if your application is accepted. This means the company cannot:

- Refuse to sell you any Medigap policy it offers

- Charge you more for a Medigap policy than they charge someone with no health problems

- Require you to wait for coverage to start. (There are exceptions to this.)

Please find a link to complete details in the work cited at the bottom of the page.

Within your Medigap Open Enrollment Period, you have the right to buy any Medigap policy offered in your state, and you will often get superior prices along with additional policies to choose from.

To her delight, Maggie locates a detailed chart that displays the Medicare Supplement or Medigap plans offered by ManhattanLife. She examines the benefits and percentages covered under Plans A, C, F, G, and N.

* Starting January 1, 2020, Medigap plans that cover the Part B deductible (Plans C and F) won’t be available to people new to Medicare. If you have one of these plans (or the high deductible version of Plan F), you can keep it. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may buy one of these plans with the Part B deductible coverage.

** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

If you apply for Medigap coverage after your Open Enrollment Period has finished, there is no guarantee that an insurance company will sell you a Medigap policy if you do not meet the medical underwriting requirements. The exception to this might be that you are eligible for guaranteed issue rights, also referred to as Medigap protections.

Furthermore, your Medigap rights may depend on when you choose to enroll in Medicare Part B. If you are 65 or older, your Medigap Open Enrollment Period begins when you enroll in Part B, and it cannot be changed or repeated.

Our prudent protagonist, Maggie, notices another stipulation that concerns employer coverage:

If you already have group health coverage from an employer or union, it may be best to wait before enrolling in Part B. Benefits based on current employment often provide coverage like Part B, so you would not want to pay for Part B before you need it. Of course, a Medigap Open Enrollment Period may also expire before a Medigap policy is helpful.

Maggie glances further down the page and spots something called Medicare SELECT. She proceeds to raise an eyebrow with curiosity…

For more info, please visit ManhattanLife Medicare Supplements

Centers for Medicare & Medicaid Services. 2022. 2022 Choosing a Medigap Policy

Kaiser Family Foundation. 2019. Medicare Overview