The Debt We Leave Behind - How Individual Life Insurance Can Help

Table of Contents

Term Life - Protection for young adults

Term Life - Protection for families

Term Life - Combination term life insurance and critical illness benefits

Term Life - Mortgage Protection

Whole Life - Fully Underwritten

Summary

While it can be an unpleasant topic, it is basically a necessity to talk about life insurance. Protecting your family’s financial future is important whether you’re a young adult starting out or an older adult already settled. We can leave behind more debt and financial responsibilities than we realize. Our estates are meant to cover our outstanding debt, but life insurance can play a pivotal role in helping our families receive adequate financial help.

Going from a two-income to a single-income household especially can create a need for a transition period. In addition to funeral costs, lump sum payments can also help the surviving spouse adjust to balancing previously shared or divided expenses: mortgage payments, childcare, utility bills, car payments, insurance, etc. The median monthly housing cost was$1,609 in 2019 according to the U.S. Census Bureau, and the average utility cost is around $400 in 2020.

The National Funeral Directors Association (NFDA) found that the median cost of a funeral without a vault was $7,640 as detailed in their chart below. Since the 1960s, the NFDA has calculated the median cost of a funeral with burial by totaling the costs of the following items: basic services fee, removal/transfer of remains to funeral home, embalming and other preparation of the body (casketing, cosmetology, dressing and grooming), a metal casket, use of facilities and staff for viewing and a funeral ceremony, use of a hearse, use of a service car/van, and a basic memorial printed package (e.g., memorial cards, register book, etc.). The cost does not consider cemetery, monument or marker costs or miscellaneous cash-advance charges, such as for flowers or an obituary.

National Median Cost of an Adult Funeral with Viewing and Burial: 2019 vs. 2014

| Item | 2019 | 2014 | % Change |

|---|---|---|---|

| Nondeclinable basic services fee | $2,195 | $2,000 | 9.8% |

| Removal/transfer of remains to funeral home | $350 | $310 | 12.9% |

| Embalming | $750 | $695 | 7.9% |

| Other preparation of the body | $255 | $250 | 2.0% |

| Use of facilities/staff for viewing | $425 | $420 | 1.2% |

| Use of facilities/staff for funeral ceremony | $500 | $495 | 1.0% |

| Hearse | $340 | $318 | 6.9% |

| Service car/van | $150 | $143 | 4.9% |

| Printed materials (basic memorial package) | $175 | $155 | 12.9% |

| Metal burial casket | $2,500 | $2,395 | 4.4% |

| Median Cost of a Funeral with Viewing and Burial | $7,640 | $7,181 | 6.4% |

| Vault | $1,495 | $1,327 | 12.7% |

| Total with Vault | $9,135 | $8,508 | 7.4% |

The NFDA used specific options when calculating and total costs can vary depending on individuals' final choices.

Life Insurance Options – Term Life and Whole Life

What is Term Life Insurance?

You choose a specific “term” such as 15 or 20 years. Your policy is inforce for the term selected, and your beneficiary receives the policy’s face amount as a death benefit payment if you pass away during the policy term.

Term Life Options from ManhattanLife

ManhattanLife offers several individual term life insurance options. We have designed each option with a different life stage in mind. No matter where you are now, we hope to have an insurance policy that fits your needs.

Viva Life Professional

For young adults. Viva Life Professional provides basic life insurance coverage and includes an optional Accidental Death rider. 20- and 15-year level term options, depending on your age, and no medical exam required!

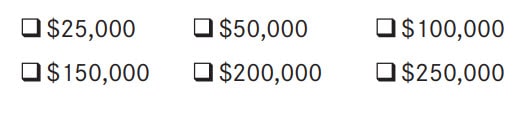

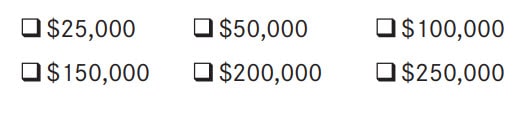

6 base coverage amount options:

Viva Life Family

For full family coverage. Viva Life Family offers the options to add a spouse as an additional insured and a children’s insurance benefit. Includes an optional Accidental Death rider. 20- and 15-year level term options, depending on your age.

6 base coverage amount options:

Viva Living Benefits

Combination term life insurance and first occurrence critical illness benefit. 20- and 15-year level term options, depending on your age. The critical illness benefit covers life threatening cancer, heart attack, major organ transplant, paralysis, renal failure, and stroke.

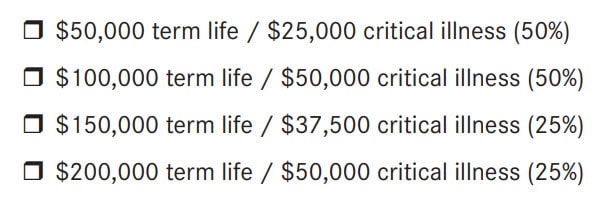

4 base coverage amount options:

Mortgage Protection

Simplified issue level term insurance up to $250,000. Choose from 15, 20, 25, or 30-year term options and a variety of optional riders, depending on the plan you choose and your resident state:

- Accident Only Disability Income

- Accidental Death Benefit

- Additional Insured Rider

- Children’s Insurance Rider

- Critical Illness Benefit

- Waiver of Premium

What is Whole Life Insurance?

Whole life insurance covers the insured for their lifetime. Whole life policies pay the face amount as the death benefit and can also accumulate cash value.

Whole Life from ManhattanLife

Viva LifeTime (Simplified Issue)

Simplified whole life option with no medical exam required. Premiums stay the same and guaranteed cash values accumulate on a tax deferred basis. We offer face amounts from $20,000 to $100,000 for adults and a variety of payment options: LifeTime Pay, Paid up at age 65, and 20 pay.

Family Protection Premier (Fully Underwritten)

A fully underwritten whole life plan. Face amounts range from $25,000 to $3,000,000 for adults, and you can choose from a variety of payment options: LifeTime pay; 3,5,10, or 20 pay; Paid up at age 65. Customize your policy with optional riders:

- Accidental Death Benefit

- Children’s Insurance Rider

- Waiver of Premium

- 20-Year Level Term Rider

Have an agent contact you with more information on life insurance from ManhattanLife or review our Life Insurance page.

Note: Tax advisors should be contacted with estate tax or other tax questions on death benefits.