What Can I Do to Protect Myself from Holiday Scams?

Holiday Scams and Fraud

Table of Contents

What Are the Costs of Fraud and Scams?

What are Common Holiday Scams?

What are Signs that It’s A Scam?

How Do I Protect Myself from Scams?

What Do I Do If I’m the Victim of Fraud or a Holiday Scam?

What Are the Costs of Fraud and Scams?

In 2018 alone, the Internet Crime Complaint Center (IC3) estimated that “non-delivery” and “non-payment” scams together affected more than 65,000 victims, causing almost $184 million in losses.1 The Federal Trade Commission reported that 3.2 million people filed reports in 2019, and 1.7 million were fraud reports, imposter scams, identity theft, and other reports. More than $1.9 billion was lost to fraud in 2019 – an estimated $667 million of that was lost to imposter scams.2

Fraud and scams don’t just affect individuals. In 2019, the Better Business Bureau found that business email compromise scams have cost businesses and other organizations more than $3 billion since 2016.3

As the number of reported scams and fraud attempts increase every year, it’s important to be aware and informed on how they work and when they’re most prevalent. One of the times that scammers work extra hard is during the holidays, when they can take advantage of the increased amount of shopping and donating. This year especially, as the majority of shopping will be done online, scammers will have plenty of opportunities.

What are Common Holiday Scams?

Non-delivery scams

Non-delivery scams affect the buyer. You pay for something but never receive the item, and the seller becomes hard to reach or unreachable completely.

Non-payment scams

Non-payment scams affect the seller. You ship the item but never receive payment, and the buyer becomes hard to reach or unreachable completely.

Phony Package Delivery Failure

Scammers send realistic-looking email or text notifications of delivery failure and request follow up information. Call the local post office or the delivery service to verify before giving out any information through email, text message, or on the Internet.

Public Wi-Fi

In general, you should avoid connecting to public Wi-Fi to access bank accounts or any other sensitive data. Scammers pay special attention to hotels, coffee shops, and other places that offer free Wi-Fi. When someone tries to connect, the scammer sends pop-ups requesting the person install an app or software before connecting.

Holiday E-Card Malware

Be on alert for an influx of holiday themed emails from unknown senders. If you’re tempted to click on links in an email, you can use your mouse to hover over the hyperlink and verify the destination.

Fake Charities

Scammers will create fake charities to ask for donations. You may receive phone calls, texts, or emails from an official or familiar-sounding charity asking for donations. The email or text may have a link that takes you to a fake website. The link itself could download malware once you click it. Research the charity before visiting any website.

Holiday Vacation Scams

Beware fake travel sites and too-good-to-be-true offers. Research travel agencies before providing any personal information or clicking any links in emails or text messages.

Auction Fraud

The item you receive is not the same as the one pictured on the website. This is most common on auction sites. Look for reviews and a return policy.

Gift Card Fraud

A seller asks you to purchase a gift card and give them the numbers on the back of the card as payment.

What are Signs that It’s A Scam?

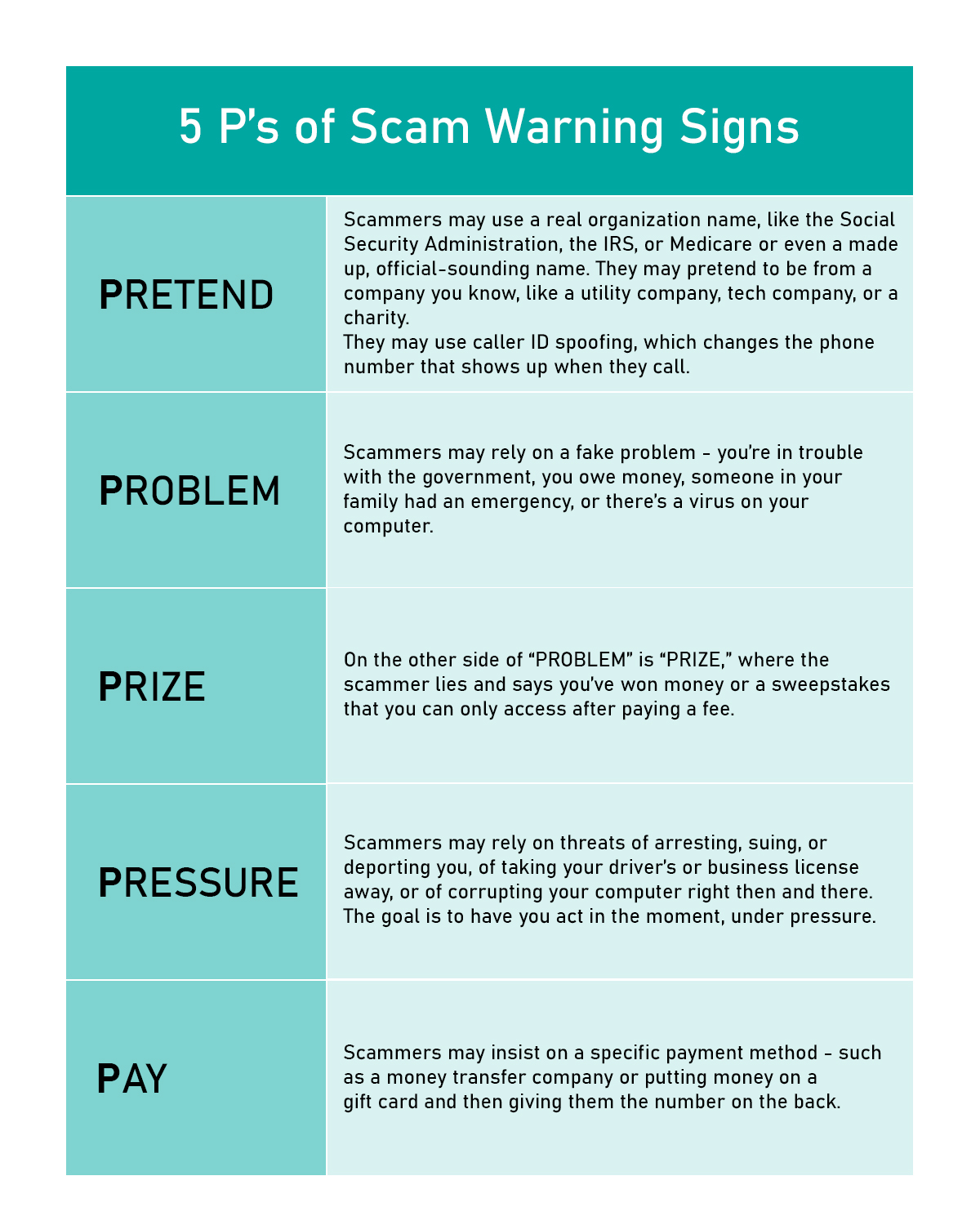

The Federal Trade Commission defined 5 P’s to watch out for when it comes to scammers.

- PRETEND

- PROBLEM

- PRIZE

- PRESSURE

- PAY

Other Scam Warning Signs

- Huge discounts, especially when featured on social media posts or unfamiliar websites.

- Spelling errors or poor grammar on a shopping website or in an email.

- A shopping or travel site does not list a phone number or street address for the business and offers only an email address or a fill-in contact form.

- The site doesn’t have a privacy policy.

- An email from an unknown sender asking you to click on a link or download an app to access a deal or arrange a delivery.

How Do I Protect Myself from Scams?

Whether it’s a holiday scam or a regular scam, you can help protect your identity and financial information. Here are tips from the Federal Trade Commission, the FBI, and the Better Business Bureau.

- Resist the urge to act immediately under pressure. Verify as much information as you can before acting, whether it’s reaching out to family members or your bank directly or researching phone numbers and charity names.

- Know the facts. For example, the IRS will never request personal financial information by email, text, or any social media, and Social Security numbers are never “suspended.”

- When shopping on an unfamiliar website, look for clearly stated and easy to find return and refund policies.

- Look at the reviews. Be more cautious of buyers and sellers who have mostly negative reviews/feedback or no ratings at all.

- If you’re shopping on a new site or buying from an unfamiliar vendor, search their names with “scam,” “complaints,” “reviews,” or similar terms.

- Get tracking numbers for your online purchases and check on your delivery estimates often.

- Avoid sellers who post using one name but ask for payment to be sent to someone else.

- Avoid paying via wire using a money transfer company, a prepaid card, or a bank-to-bank wire transfer. It’s virtually impossible to recover money sent in these ways. Credit cards can be a safer way to pay in most cases.

- Most credit cards offer extra protection for online purchases, and many cards offer other benefits like protection for returns. Check with your credit card company for full details and benefits.

- Watch out for sellers who are suddenly hard to get a hold of after a sale.

- Avoid buyers who ask for their purchase to be shipped in ways that would avoid customs or taxes inside another country.

What Do I Do If I’m the Victim of Fraud or a Holiday Scam?

If you do become the victim of a holiday scam, contact your bank immediately. You should also inform your local law enforcement agency. You can file a complaint about an Internet crime to IC3 at ic3.gov or report fraud to the Federal Trade Commission.

Sources: 1. FBI Internet Crime Complaint Center (IC3), 2018 Internet Crime Report. 2. Federal Trade Commission (FTC), Consumer Sentinel Network Data Book 2019. 3. Better Business Bureau (BBB), The Explosion of Business Email Compromise (BEC) Scams.