Introducing: Accident Indemnity Plus

Accident Indemnity Plus

Offers supplemental coverage for accidents, injuries, ambulance services, accidental death, and more. Like our current accident plan, protection goes beyond basic health coverage and helps cover deductibles and other services your standard health care coverage may not provide.

Offering three levels of coverage, the plan provides flexibility and choice. There is no limit to the number of accidents payable per year (maximums may apply to specific benefits). Coverage starts at zero with each new accident and benefits pay in addition to any coverage in place.

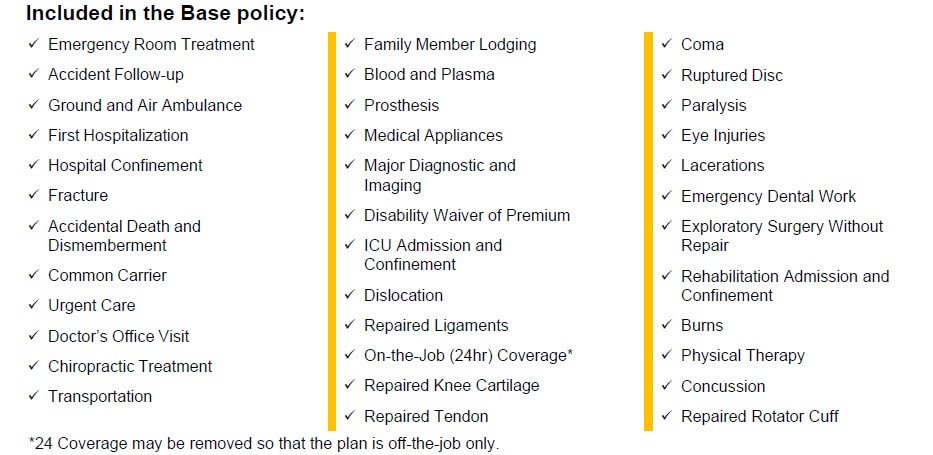

Accidents vary greatly by type and severity. Accident Indemnity Plus provides specific coverage amounts based on the differing care and treatment required. We provide the insured with a wide variety of embedded benefits. In addition, the base benefit covers you on AND off the job!

We also offer five additional Optional Benefits:

Well-Being, Loss of Work, Youth Organized Sport, Catastrophic Accident, and Employer Facility Benefit.

At ManhattanLife, we understand employers have very different and specific employee needs. Accident Indemnity Plus is a plan that accounts for multiple types of accident scenarios at an affordable and highly competitive rate. Our three level policy option allows your groups to select coverage that best suits their needs. We will continue to sell our unique and robust Accident Reimbursement Plus product as well, providing our partners options to meet the needs of employer groups.

Please contact your sales associate today or email us at VBSales@ManhattanLife.com to learn more about our exciting plan!

The Insurance coverage provided under the policy does not constitute comprehensive health insurance coverage (often referred to as “major medical coverage”) and does not satisfy the requirement of minimum essential coverage under the Patient Protection and Affordable Care Act. This is not a complete disclosure of plan qualifications and limitations. Please review this information before applying for coverage. For a complete list of exclusions, please visit Disclosure.Manhattanlife.com. The benefitsprovided depend on the plan selected and premiums vary according to the selection made.