How Much Can a Medigap Plan Save You When Medical Bills Stack Up? We Did the Math.

MEDICARE SUPPLEMENT

A Medicare Supplement plan, also called a Medigap plan, is designed to cover the healthcare costs that Medicare won't. In order to show how important a Medigap plan can be in protecting you from out-of-pocket costs, we calculated how much money a Medigap plan would save you in the event of an unlikely, yet completely possible, serious medical issue.

MEDICARE PARTS A & B

PART A DEDUCTIBLE

In 2020, the Medicare Part A deductible is $1,408. Those with Original Medicare must pay this deductible for each 60-day benefit period. This means that if you were to be admitted to a hospital after 60 days, you would have to pay the $1,408 deductible again. If you were to visit the hospital 4 times in one year, a Medicare Supplement plan, also called a Medigap plan, could save you $5,632. Medicare Supplement plans B, C, D, F, G, and N cover 100% of the Part A deductible, while plan L covers 75% and plans K and M cover 50%.

HOSPITAL STAY

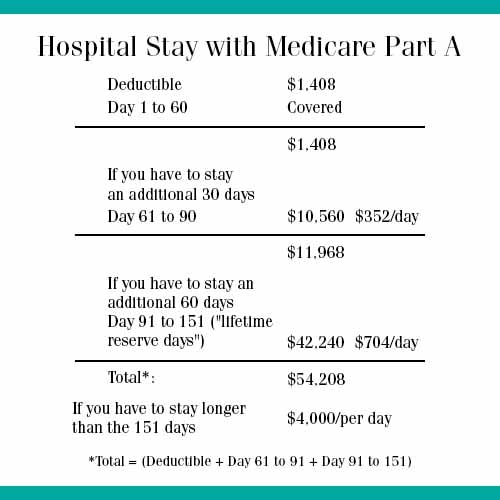

If you need to stay in the hospital, Original Medicare will cover your first 60 days. From day 61 to day 90, however, you will have to pay $352 per day for a total of $10,560.

From the 91st day on, those with Original Medicare would have to pay $704 per day for the next 60 days, called your “lifetime reserve days”. Without a Medicare Supplement plan, you only get 60 lifetime reserve days for your entire lifetime. Once those are used, your stay in the hospital could cost you as much as $4,000 a day, based on an article written in Money Magazine.

If you had any of the Medigap plans offered in your state, you would be covered for all of the costs you accumulated during your “lifetime reserve days”, which would be a total of $42,240. After that, you would also receive an additional 365 days’ worth of hospital coverage. Medicare does not cover any costs after your “lifetime reserve days”, so a Medigap plan could save you $4,000 per day for 215 days if you were to need to spend the rest of the year in the hospital, totaling to $860,000.

SKILLED NURSING COSTS:

If you required care from a Skilled Nursing Facility, you would have to pay $176 from days 21-100 if you only had Original Medicare, totaling to $14,080. Most Medigap plans will cover 100% of these costs, apart from plans A, B, K and L.

PART B DEDUCTIBLE

The annual Medicare Part B deductible in 2020 is $198, and is covered by Medicare Supplement plans C and F.

DOCTOR FEES (SAVINGS WILL VARY)

With Original Medicare, you still pay 20% of the Medicare-approved amount for most doctor services. Medicare Supplement plans F or G would cover 100% of what your left with from doctor fees, as well as 100% of any charges your doctor may charge you beyond the Medicare reimbursement rate. The amounts of these costs will vary based on the services you receive from your doctor and the amount they charge.

BLOOD

Original Medicare does not cover your first 3 pints of blood, which cost about $150 each. All Medicare Supplement plans, apart from plans K and L, will cover 100% of the cost of the first 3 pints of blood as needed. Plan K covers 50% while Plan L covers 75% of this cost.

FOREIGN TRAVEL EMERGENCY

Original Medicare does not cover any foreign travel emergencies. Medicare Supplement plans C, D, F, G, M, and N provide foreign travel health coverage of 80% of your healthcare costs up to $50,000.

DOING THE MATH

If you add all the costs above, a Medicare Supplement, or Medigap, plan could save you over $950,000. Now, it would be extremely unlikely to undergo a medical emergency that would accumulate all the costs above, but serious medical emergencies do happen. As you can see, medical expenses can seriously stack up, and without the protection of a Medicare Supplement plan, you could be stuck with paying for them out-of-pocket.

Have an agent contact you with more information or visit our Medicare Supplement page for more information.

For more information on what Medicare Part A covers.

CMS.gov Fact Sheet – 2020 Medicare Parts A & B Premiums and Deductibles