Why Buy an FIA?

Accumulate funds for retirement

Ability to withdraw portions of your money without any penalties

Participate in potential market gains without the downside risk

Downside Protection

Even if the value of the chosen strategy goes down, you will not lose money due to negative index performance.

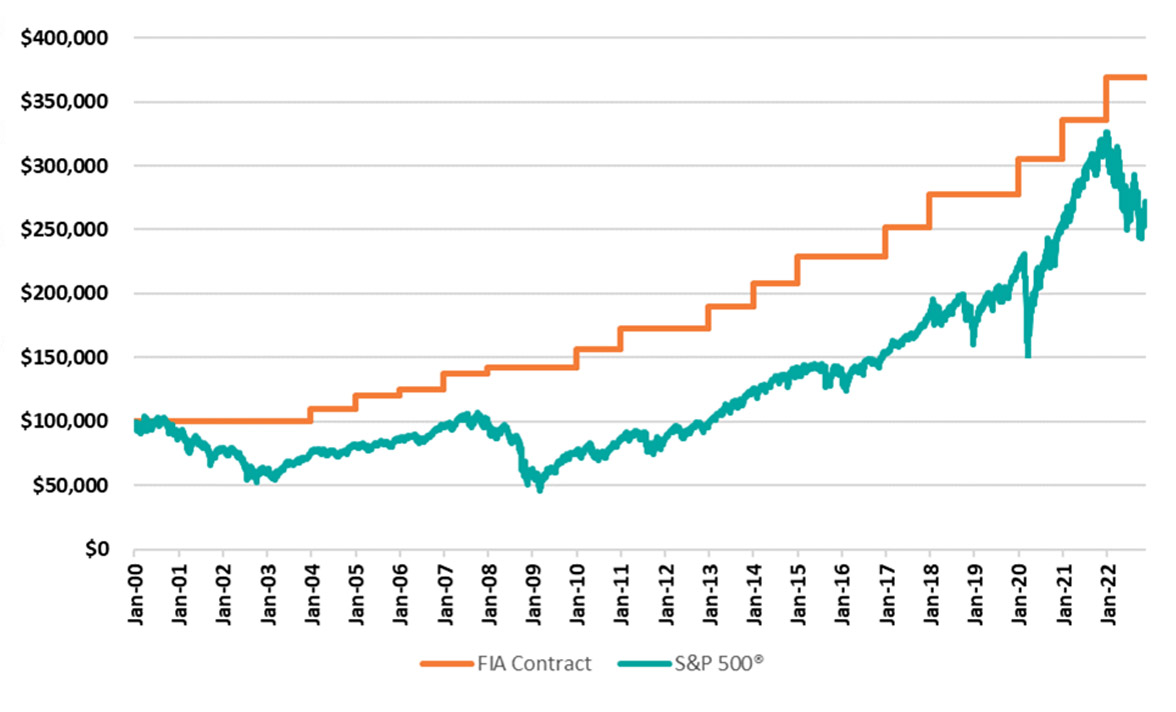

Power of Principal Protection and Annual Reset

This is a hypothetical example and does not illustrate the future results of either the market or your FIA contract. This example assumes no partial or full surrenders and that all funds are allocated to the Point-to-Point with Cap Strategy at a cap of 6%. Actual and future cap rates may be above or below this amount. This example is for illustrative purposes only and does not represent the performance of any specific product or investment.

How does it work?

Options

Options

Choose from a variety of available index–linked crediting strategies or a fixed interest rate strategy.

Grow

Grow

Earn interest on your annuity value based on the performance your chosen crediting strategies.

Flexibility

Flexibility

Each year you have the option to adjust your crediting strategies.

Available Indices

Additional Features

Premium Bonus

The Premium Bonus Rider adds additional Interest credit to your annuity value based on a percentage of the premium used to purchase your annuity. The bonus will participate in the potential market growth alongside your premium. The longer your contract remains in-force, the more your premium bonus will grow.

Rate Enhancement Rider

For a fee, the Rate Enhancement rider will increase indexed crediting strategy rate(s) for higher potential market returns. At the beginning of your contract, and every subsequent contract year, you may add or remove the rider from any available indexed crediting strategies.

Surrender Waivers

There are two riders provided at no additional cost that provide waivers of surrender charges under certain circumstances. They are The Nursing Home Waiver and Terminal Illness Waiver.

ManhattanLife is a group of operating life and health insurance companies: Manhattan Life Insurance Company, Western United Life Assurance Company, ManhattanLife Insurance and Annuity Company, Family Life Insurance Company, and Standard Life and Casualty Insurance Company.

ManhattanLife was founded in 1850 and was one of the early pioneers in the life insurance industry. Since then, ManhattanLife and its affiliated companies have provided secure and innovative life and health insurance products and services to more than 700,000 policy and contract holders throughout the United States.

Withdrawals made prior to age 59½ are subject to ordinary income taxation and may be subject to tax penalties. Neither ManhattanLife nor any of its subsidiaries or representatives provide tax, legal, or accounting advice. Please consult your personal tax advisor.

This annuity is NOT: 1) a certificate of deposit (CD); 2) FDIC or NCUA insured; 3) insured by any federal government agency; or 4) guaranteed by a bank, savings association, or credit union. Guarantees are based on the financial strength and claims-paying ability of ManhattanLife.

This material is intended for use with the general public to provide educational information only. It should not be considered, and does not constitute, personalized investment advice. Please contact one of our insurance producers for product details and benefits.

The S&P 500® is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by ManhattanLife Companies (“Licensee”). S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Licensee. Licensee's Fixed Indexed Annuity is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500®.

Neither Barclays Bank PLC ('BB PLC'') nor any of its affiliates (collectively 'Barclays') is the issuer or producer of a fixed indexed annuity (the “Fixed Indexed Annuity”) and Barclays has no responsibilities, obligations, or duties to Contract holders of the Fixed Indexed Annuity. The Barclays Novus 5% Volatility Control Index (the 'Index'), together with any Barclays indices that are components of the Index, owned by Barclays and, together with any component indices and index data, is licensed for use by the ManhattanLife Companies as the issuer or producer of the Fixed Indexed Annuity (the ‘Issuer’).

Barclays’ only relationship with the Issuer in respect of the Index is the licensing of the Index, which is administered, compiled, and published by BB PLC in its role as the index sponsor (the 'Index Sponsor') without regard to the Issuer or the Fixed Indexed Annuity or Contract holders in the Fixed Indexed Annuity. Additionally, the Issuer or producer of the Fixed Indexed Annuity may for itself execute transaction(s) with Barclays in or relating to the Index in connection with the Fixed Indexed Annuity. Contract holders acquire the Fixed Indexed Annuity from the Issuer and Contract holders neither acquire any interest in the Index nor enter any relationship of any kind whatsoever with Barclays upon making an investment in the Fixed Indexed Annuity. The Fixed Indexed Annuity is not sponsored, endorsed, sold, or promoted by Barclays and Barclays makes no representation regarding the advisability of the Fixed Indexed Annuity or use of the Index or any data included therein. Barclays shall not be liable in any way to the Issuer, Contract holders or to other third parties in respect of the use or accuracy of the Index or any data included therein.

The Barclays Novus 5% Volatility Control Index has been developed in part by Novus Partners, Inc. Novus Partners, Inc. is not an investment advisor and does not guarantee the accuracy and completeness of the Barclays Novus 5% Volatility Control Index or any data or methodology either included therein or upon which it is based. Novus Partners, Inc. shall have no liability for any errors, omissions or interruptions therein and makes no warranties expressed or implied, as to the performance or results experienced by any party from the use of any information included therein or upon which it is based, and expressly disclaims all warranties of the merchantability or fitness for a particular purpose with respect thereto, and shall not be liable for any claims or losses of any nature in connection with the use of such information, including but not limited to, lost profits or punitive or consequential damages even, if Novus Partners, Inc. is advised of the possibility of same.